Understanding Collision Coverage

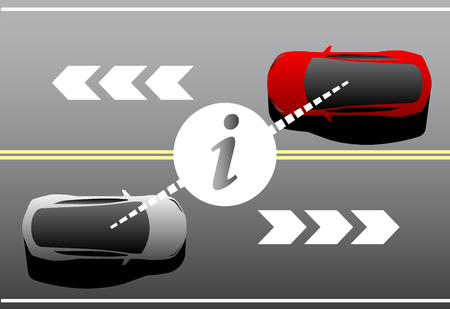

In the United States, auto insurance is more than just a legal requirement—it’s an essential part of responsible driving. Among the different types of coverage available, collision coverage plays a key role in protecting your vehicle and your finances. But what exactly is collision coverage? At its core, collision coverage helps pay for damage to your car if you’re involved in an accident with another vehicle or if you hit an object, such as a tree or guardrail, regardless of who is at fault. Unlike liability coverage, which only covers damages to others and their property, collision coverage is all about safeguarding your own ride.

Most American drivers choose to include collision coverage in their auto insurance policies, especially if they have a newer or higher-value vehicle. This is because the cost of repairing or replacing your car after an accident can be substantial—and without collision coverage, those expenses come straight out of your pocket. While it’s not legally required by state law, lenders and leasing companies usually mandate collision coverage if you finance or lease your car. Ultimately, understanding how collision coverage works and why it’s commonly included can help you make smarter choices when it comes to protecting yourself on the road.

2. Financial Risks of Going Without

Choosing to forgo collision coverage can expose American drivers to significant financial risks, especially in the event of an accident. Unlike liability insurance, which only covers damages to others if you’re at fault, collision coverage helps pay for repairs to your own vehicle regardless of who caused the accident. Without this protection, every cost comes out of your pocket.

Out-of-Pocket Costs After an Accident

If you get into a crash and don’t have collision coverage, you’ll be responsible for all repair or replacement costs for your vehicle. Even minor fender-benders can result in repair bills that run into thousands of dollars. If your car is newer or financed, these expenses can be particularly overwhelming.

Financial Impact Scenarios

| Situation | Potential Out-of-Pocket Cost |

|---|---|

| Minor Accident (e.g., dented bumper) | $500–$1,500 |

| Major Collision (frame damage, airbags deployed) | $5,000–$10,000+ |

| Total Loss (car is “totaled”) | Full value of car minus salvage value; typically $10,000–$30,000 depending on car’s worth |

When Your Car Is Totaled

If your vehicle is declared a total loss after an accident and you don’t have collision coverage, you will not receive any payout from your insurance company to replace it. You’ll need to cover the entire cost of buying another car yourself—even if you still owe money on a loan or lease. This situation can leave drivers stranded financially and without reliable transportation. In America’s car-dependent communities, this risk can disrupt daily life and even impact employment opportunities.

3. Real-Life Scenarios: When Trouble Hits

Let’s imagine a few all-too-common American scenarios where not having collision coverage can make a world of difference. Picture this: you’re driving home from work on a rainy evening in Seattle, and suddenly traffic stops short. You brake hard, but your car slides into the vehicle in front of you. It’s just a minor fender-bender—nobody’s hurt, but your bumper is crushed. Without collision coverage, you’re responsible for every dollar it takes to get your car back on the road. Now, consider another scenario straight out of rural America: you’re taking a scenic drive through upstate New York when a deer darts across the highway. You swerve, but still hit it—damaging your hood and headlights. Again, with no collision coverage, the repair bill (which could run thousands) lands squarely on your shoulders.

These stories aren’t rare. In fact, they happen daily across the country—from crowded city streets to quiet country roads. Without the safety net of collision insurance, drivers are left scrambling to cover unexpected costs out-of-pocket. For many Americans living paycheck to paycheck or prioritizing eco-friendly electric vehicles that may cost more to repair, this financial burden can be overwhelming. Some might even be forced to delay repairs or drive unsafe vehicles, risking further damage and compromising sustainability goals.

Ultimately, these real-life examples underline the importance of thinking beyond just “getting by” with basic insurance. When life throws a curveball—whether it’s urban gridlock or wildlife on rural roads—the absence of collision coverage can turn an inconvenient accident into a long-lasting financial setback.

4. Legal and Loan Implications

When considering whether to opt out of collision coverage, its crucial to understand both the legal requirements and the obligations you may have if your vehicle is financed or leased. While no state in the U.S. mandates collision coverage by law, the story changes when a lender or leasing company is involved.

Is Collision Coverage Legally Required?

Unlike liability insurance—which is mandatory in almost every state—collision coverage is not required by any state law. Liability insurance protects others if you cause an accident, while collision coverage protects your own vehicle regardless of fault. Here’s a quick comparison:

| Type of Coverage | Legally Required by State? | Purpose |

|---|---|---|

| Liability Insurance | Yes (almost all states) | Covers damages/injuries to others |

| Collision Coverage | No | Covers damage to your own car after a collision |

Lender and Leasing Company Requirements

If you are still paying off a car loan or have a leased vehicle, most lenders and lessors will require you to carry collision coverage as part of the contract terms. This protects their financial interest in the vehicle until the loan is paid off or the lease ends. Failing to maintain this coverage can result in your lender force-placing their own insurance policy on your vehicle—often at a much higher cost and with less favorable terms for you.

Potential Consequences of Dropping Collision Coverage with a Loan or Lease:

- Breach of contract with your lender or leasing company

- Forced placement of costly insurance by your lender

- Possible repossession of your vehicle in extreme cases

- Long-term credit implications if payments lapse due to increased costs

Sustainable Choices Matter

While dropping collision coverage might seem like a way to save money, it’s important to weigh these legal and contractual implications carefully. Making informed decisions helps protect not only your finances but also supports responsible and sustainable ownership within your community.

5. Impact on Sustainability and The Environment

When you don’t have collision coverage, the immediate financial setbacks are only part of the story—the environmental consequences can ripple through your community for years to come. Without insurance to help repair or salvage your damaged vehicle, there’s a higher chance your car may be left unrepaired or even abandoned. This not only contributes to urban blight but also hinders efforts toward environmental sustainability.

Unrepaired vehicles that end up in junkyards or abandoned lots often leak harmful fluids such as oil, coolant, and gasoline into the soil and groundwater, posing a threat to local ecosystems. In contrast, when a car is repaired or responsibly recycled after an accident, usable parts are salvaged, metals are repurposed, and hazardous materials are managed properly—greatly reducing their impact on the environment.

From a broader perspective, every car that is successfully repaired or recycled keeps valuable resources in circulation and minimizes the need for new manufacturing—a win for both sustainability goals and climate action. When more people lack collision coverage and opt not to repair or recycle their vehicles, it can lead to increased waste, resource depletion, and missed opportunities for energy-efficient reuse within the automotive industry.

For communities striving toward green initiatives and zero-waste goals, responsible vehicle management is essential. By having adequate insurance like collision coverage, you’re not just protecting yourself—you’re contributing to a cleaner, safer environment for everyone. This collective responsibility helps foster a culture of sustainability, where resources are conserved and environmental impacts are minimized for future generations.

6. Tips for Making a Greener Insurance Choice

When you’re weighing whether or not to have collision coverage, it’s also a perfect time to consider the environmental impact of your insurance decisions. Green living isn’t just about driving a fuel-efficient car—it’s about making conscious choices in every aspect of ownership, including your insurance. Here are some ways Americans can align their coverage with sustainable values:

Choose Policies That Incentivize Eco-Friendly Behavior

Many insurers now offer discounts or specialized policies for drivers who use hybrid or electric vehicles. If you’re considering dropping collision coverage because you drive less or own an older, more sustainable vehicle, check if your insurer has low-mileage or usage-based plans that reward eco-friendly habits.

Consider Comprehensive Coverage for Environmental Risks

While collision covers damage from accidents, comprehensive insurance can protect against natural disasters—an increasingly relevant concern as climate events become more frequent. This not only shields you from financial loss but also encourages responsible stewardship by addressing risks like wildfires, flooding, and storms.

Support Insurers With Sustainable Practices

Look into companies committed to reducing their own carbon footprint—some offset emissions, invest in renewable energy, or promote paperless policy management. Choosing such a provider amplifies your positive impact beyond personal choices.

Think About Responsible Vehicle Ownership

If you opt out of collision coverage on an older car, ensure the vehicle remains safe and efficient on the road. Regular maintenance extends its life and reduces waste. When it’s time to upgrade, consider trading up to a greener model and adjusting your insurance accordingly.

Making Smart, Sustainable Insurance Decisions

Your insurance choices play a part in the bigger picture of environmental responsibility. By selecting coverage that matches both your budget and your sustainability goals, you protect yourself—and the planet—for years to come.